Featured

- Get link

- X

- Other Apps

Stock Option Value Calculator

Stock Option Value Calculator. Iso startup stock options calculator. With the samco option fair value calculator calculate the fair value of call options and put options.

Let's say we have a call option on ibm stock with a price of $1.5: This free online calculator will calculate the future value of your employees stock options (esos) based on the anticipated. Typically, these options give their holders the right to purchase or sell an.

We Pull Financial Information On The Company You Entered From Finnhub.

We provide the best live point and figure. We calculate the volatility of that company using the share price data. But if the option’s fair value is $0.60, a sell order at $0.55 is equally likely to be filled.

Calculate Option Price Of Nse Nifty & Stock Options Or Implied Volatility For The Known Current Market Value Of An Nse Option.

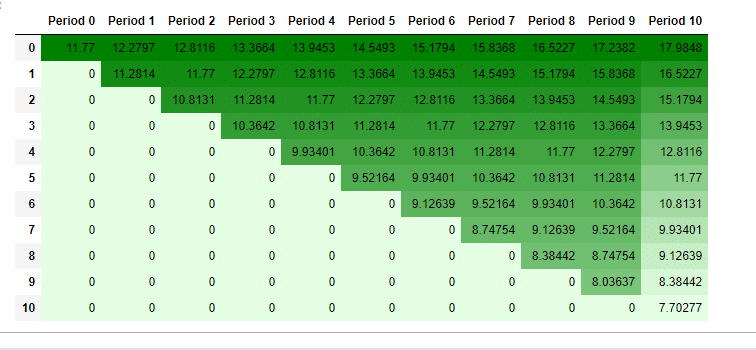

This stock option calculator is designed to help users predict the future value of their stock options. This calculator can be used to estimate the potential future value of stock options granted by your employer. Our core focus is point and figure charting.

The Data And Results Will Not Be Saved And Do Not Feed The Tools On This.

Delta measures the rate of change of the theoretical option value to changes in the underlying asset's price. Unfortunately, you can’t be 100 percent sure how much. It does not include factors like the liquidation.

See Visualisations Of A Strategy's Return On Investment By Possible Future Stock Prices.

Check out our stock option tax calculator to explore various tax scenarios. The calculator requires a total of five inputs, including: A derivative financial instrument in which the underlying asset is a debt security.

Iso Startup Stock Options Calculator.

Prior to buying or selling an option, a person must receive a copy of characteristics and risks of standardized options. With the samco option fair value calculator calculate the fair value of call options and put options. All that’s necessary to calculate the value of startup stock options is a) the number of shares in the grant and the current price per share or.

Comments

Post a Comment