Featured

- Get link

- X

- Other Apps

Calculating Profit Before Tax

Calculating Profit Before Tax. Net profit after taxes is the determinant of whether you. Earnings before tax = net profits + tax.

If you want to calculate your company's income before taxes, you need certain figures found on the balance sheet. Sales value in the case of walmart for the year ending 31 january. Firstly, determine the revenue or sales of the company and it is easily available as a line item in the income.

For Example, Say A Company Made $1,000,000 In Net Operating Income.

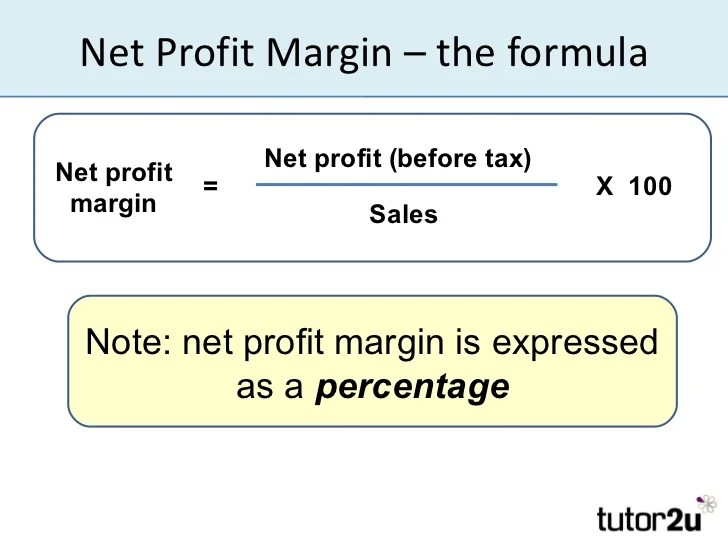

Plug the company’s net income and tax rate into the following formula: This is the simple formula for calculating net profit. The formula for profit can be derived by using the following steps:

Operational Profit Margin Let's Say You Deduct A Further.

Profit before tax, which is sometimes called earnings before tax, is the second to last line in an income statement. Your gross profit margin would be £100,000 divided by £250,000 and multiplied by 100 to get a percentage. In fact, i would rank net profit after taxes above regular operating income or net profit before taxes, and here is why:

Use The Following Steps To Perform This Calculation:

If you want to calculate your company's income before taxes, you need certain figures found on the balance sheet. Arrange the financial information about the company's sources of income. Profit before tax (pbt) is a line item in the income statement of a company that measures profits earned after accounting for operating expenses like cogs, sg&a,.

Subtract The Money Out For Debt Service.

Taxable amount = tax @28% on pbt = (28% of $4,756) = $1,331.68 therefore, as per the formula. Next, subtract operating expenses, such as office supplies and advertising and sales. There are three formulas that can be used to calculate earnings before tax (ebt):

Here's The Formula To Use When Calculating Operating Income:

Net profit is the amount of money a business. So, if the profit for the 12 months to 31 december 2021 is £12,000, the overlap profit is (96/365 × £12,000) = £3,156 (over 96 days). The profit before tax formula is as follows.

Comments

Post a Comment